The Real Benefit to You

Wealth advisors and insurance professionals choose E4 Insurance Services as their lead insurance team for our unbiased and consultative approach. What this means to you is our services are designed with the highest level of respect for your role. We communicate on every aspect of the solutions we recommend and are fully transparent in our process. As an independent partner, we focus on you and your clients’ best interest, not a particular company’s best interest. The real benefit is the knowledge, accessibility, and confidence you gain in serving your clients’ risk management and insurance needs, completely and efficiently.

We specialize in life insurance and annuities, so you don’t have to. We will treat your clients as if they are our clients by providing unbiased advice to pair each individual with the best solution for their needs.

Delivering Quality Insurance Solutions

We simplify the lives of our advisors through a personalized service model providing objective advice and consultation.

Our ultimate objective is to create a partnership with our clients that empowers them to simplify their lives, enjoy their business more and grow revenues to fulfill their vision.

Put our team to work; we “Make Life Simple”!

Industry Focused Expertise

Our unique, multi-carrier platform in conjunction with our array of benchmarking tools provides your clients with the most objective approach to insurance consultation. We bring a well-studied approach and research to the process. The real benefit is providing efficient, scalable wealth protection and wealth transfer solutions for your clients in a consultative environment.

Our Process

Our analysis allows for a complete, comprehensive review of proposed and existing policies. We report on each policy and explore how they align with the objectives you helped your client clarify.

Step 1

Quoting

You answer basic profile information regarding the client such as date of birth and coverage objective.

Step 2

Research

Our team goes through pre-underwriting procedures to determine the best offer possible and carrier

Step 3

Illustration

We offer the top solutions to you including prepared illustrations for what will best fit your client’s needs.

Step 4

Application

Clients work with a licensed representative to complete application paperwork and then return to our internal team for processing

Step 5

Delivery

Our team works in conjunction with the carrier to get your client approved as expected.

Writing advisor delivers the final policy to your client.

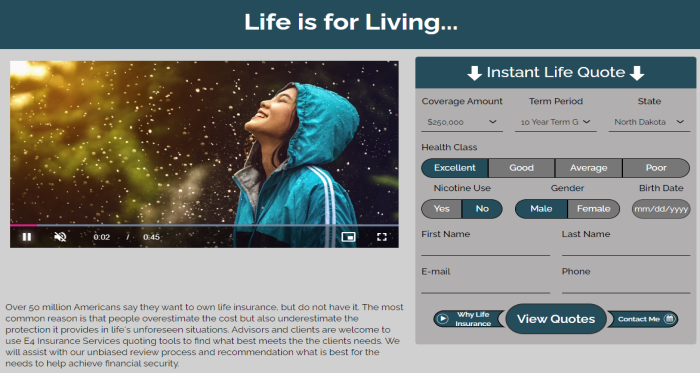

Virtual Quoting Tools

E4IS strives to provide the newest technology to our partners, including consumer-facing online quoting tools to increase your market presence. Use these tools to accurately calculate insurance needs, receive quotes from top carriers, and apply instantly. With drop-ticket capability, the process takes just minutes! See the different quoter styles here.

Interested in Your Own Customized Quoting Tools?

With your own quoting tools, you can choose which messages match your business best practices and leave the rest to us! We will customize with your logo, business information, colors, and more. Customizable text on headers paired with a video gives you the ability to run target marketing campaigns as often as you wish or permanently use your business tagline. All information is secure.